Ira withdrawal tax calculator

Once you reach age 59½ you can withdraw funds from your Traditional IRA without restrictions or penalties. Early withdrawals from an IRA trigger taxes and a 10 penalty.

Retirement Withdrawal Calculator For Excel

Youll also pay a penalty if you underestimate how much you owe in taxes.

. 529 State Tax Calculator Learning Quest 529 Plan Education Savings Account. The Calculator does not consider the effect of taxes on the RMD withdrawn and the amount owed in taxes on the withdrawal is not calculated. With a Roth IRA contributions are not tax-deductible but earnings can grow tax-free and qualified withdrawals are tax- and penalty-free.

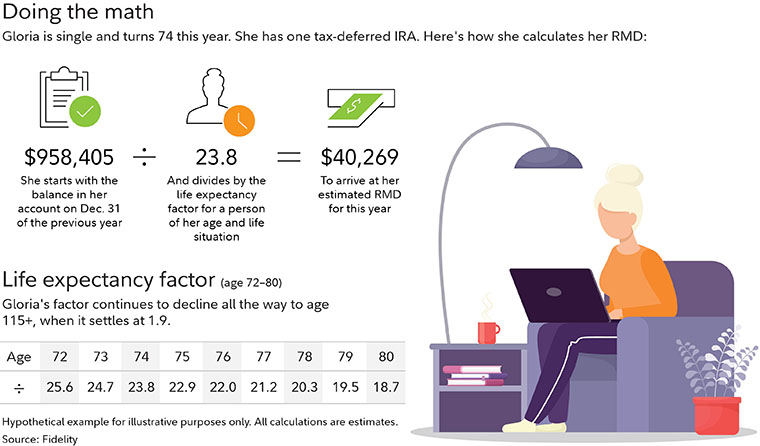

Roth IRAs are exempt from the RMD requirements while the person who contributed to the Roth IRA is alive but Roth Beneficiary accounts must take RMDs regardless of the beneficiarys age. While you still have to pay taxes on any money taken out of a 401k or IRA before a certain age there are some circumstances that would let you get around the 10 early withdrawal penalty for retirement funds. How much you must withdraw depends on the account balance and your age.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Direct contributions can be withdrawn tax-free and penalty-free anytime. As a result of the June 2020 CARES Act retirement account holders affected by the Coronavirus could access up to 100000 of their retirement savings as early withdrawals penalty free with an expanded window for paying the income tax they owed on the amounts they withdrew.

These rules will give you a good starting point on how much you can afford to withdraw from your IRA. Roth IRA Distribution Details. You die or become permanently disabled.

Only Roth IRAs offer tax-free withdrawals. The income tax was paid when the money was deposited. The 1040 income tax calculator helps to determine the amount of income tax due or owed to the IRS.

Withdrawals from traditional IRAs are taxed as regular income based on your tax bracket for the year in which you make the withdrawal. If you withdraw money before age 59½ you will have to pay income tax and even a 10 penalty. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

Youll pay income taxes and a 10 penalty tax on earnings you withdraw as of 2022. The IRS has a worksheet that can guide you through it. Concerning Roth IRAs five years or older tax-free and penalty-free withdrawal on earnings can occur after the age of 59 ½.

The amounts withdrawn arent more than your your spouses your childs andor your grandchilds qualified higher-education expenses paid during 2021. Prudent management of your IRA is vital for long-term financial security in retirement. The regular 10 early.

But sometimes early distributions are tax free and penalty free. You will receive a 1099R tax form after the end of the year showing the amount withdrawn. You wont have to pay the early-distribution penalty 10 additional tax on your Roth IRA withdrawal if all of these apply.

401K and other retirement plans. The following COVID information was for 2020 Returns. Exceptions for Both 401k and IRA.

You can also estimate your tax refund if applicable. You can make a penalty-free withdrawal at any time during this period but if you had contributed pre-tax dollars to your Traditional IRA remember that your deductible contributions and earnings including dividends interest and capital gains will be taxed as ordinary income. Exceptions to the Early Withdrawal Penalty.

You havent met the five-year rule but youre over age 59 12. You may not roll it over to another IRA or QRP. You havent met the five-year rule for opening the Roth and youre under age 59 12.

If you have a traditional individual retirement account IRA your money grows tax-deferred until you withdraw it. The 10 penalty can be waived however if you meet one of eight exceptions to the early-withdrawal penalty tax. Use this calculator to see what your net withdrawal would be after taxes and penalties are taken into account.

If you return the cash to your IRA within 3 years you will not owe the tax payment. The Inherited IRA Distribution Calculators results may vary with each use and may change over time due to updates to the Calculator or because of changes in personal circumstances or market conditions. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401k or 403b plans among others can create a sizable tax obligation.

Contributions for a given tax year can be made to a Roth IRA up until taxes are filed in April of the next year. Making withdrawals before you reach age 59 12 means you will incur a 10 early distribution penalty on top of any income taxes that are due though there are some exceptions. If you are under 59 12 you may also be subject to a 10 early withdrawal penalty.

Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors. The IRA Withdrawal Calculator which has been updated to conform to the SECURE Act of 2019 will calculate your current minimum required withdrawal and then forecast your future required withdrawals if you are an IRA owner age 70-12 or older or.

Ira Withdrawal Calculator Online 54 Off Www Alforja Cat

Ira Withdrawal Calculator Online 54 Off Www Alforja Cat

Download Traditional Ira Calculator Excel Template Exceldatapro

Ira Withdrawal Calculator Top Sellers 60 Off Www Quadrantkindercentra Nl

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Ira Withdrawal Calculator Factory Sale 52 Off Www Quadrantkindercentra Nl

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Withdrawal Calculator Factory Sale 52 Off Www Quadrantkindercentra Nl

Ira Withdrawal Calculator Factory Sale 52 Off Www Quadrantkindercentra Nl

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Withdrawal Calculator Online 54 Off Www Alforja Cat

Ira Withdrawal Calculator Factory Sale 52 Off Www Quadrantkindercentra Nl

Download Traditional Ira Calculator Excel Template Exceldatapro

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Ira Withdrawal Calculator Online 54 Off Www Alforja Cat

Ira Withdrawal Calculator Shop 50 Off Www Groupgolden Com